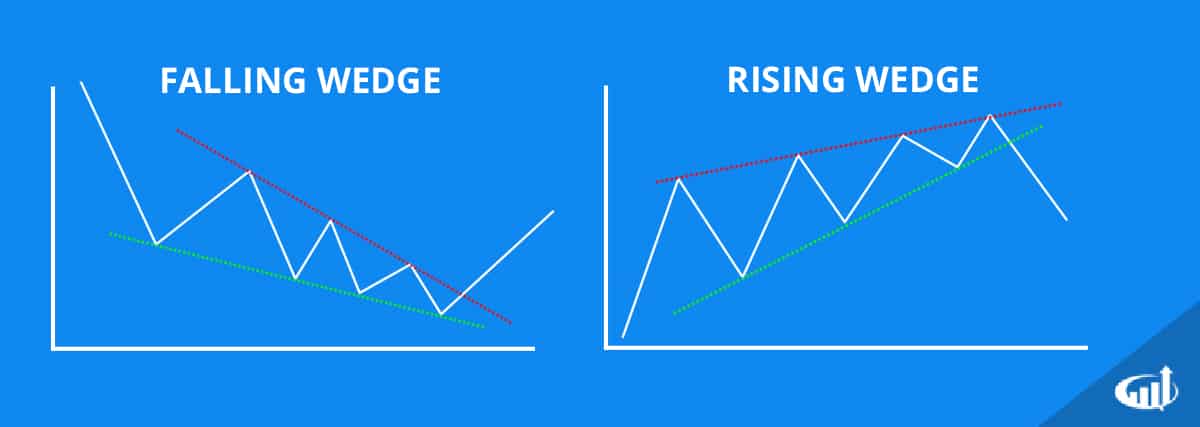

Prices tend to decline after breaking through the lower boundary line. Even though both of these lines point towards the same direction, the lower line rises at a steeper angle compared to the upper line. In a rising wedge, both the boundary lines slant up from left to right. The wedge pattern is characterized by the chart pattern when the market makes higher highs and higher lows with contracting ranges. The Rising Wedge Stock Pattern is a reversal pattern that usually takes about 3-6 month time period to form. How Does a Rising Wedge Stock Pattern Develop? The rest of the confirmation process is similar to the reversal pattern. The rising wedge consolidation can be seen in this pattern, and the lower lows and the higher highs are linked towards a narrowing point using trend lines. The continuation pattern, unlike the reversal pattern of the rising wedge, has an established downward trend. Continuation Pattern for the Rising Wedge The overbought signals are often confirmed by using other technical tools such as oscillators. The divergence between price and volume is confirmed using a volume function. The reversal patterns can be confirmed by moving average convergence divergence (MACD). Along with that, the rising wedge forms a consolidation, and the higher highs and lower lows link towards a narrowing point using trend lines. The rising wedge, when in its reversal trend, has an established uptrend. The following is a guide on confirming the reversal and the continuation patterns. Other factors are also at play here, such as contraction, volume, and the support break. The reaction low should also be higher than the previous low. Lower Support Lineįor the pattern to be considered a reversal pattern there needs to be at least two lower reaction lows so the lower support line can be formed. Tradingview Chart Pattern Illustration 3. The reaction high should also be higher than its previous high. Sometimes the pattern forms after a trend, and sometimes the trend itself is contained within the rising wedge.įor the pattern to be considered a reversal pattern, there need to be at least two reaction highs so the upper resistance line can be formed, or ideally three highs. The rising wedge pattern usually marks a long-term or an intermediate reversal of trends. Prior Trendįor the pattern to be qualified as a reversal, there needs to be a prior tend that reverses it. However, the following are the elements that must be present for there to be a rising wedge pattern. Rising wedges are considered bearish and are one of the hardest to recognize and trade. The rising wedge stock pattern occurs when there is an upward trend in the prices. The pattern is also similar to a bear flag pattern. The pattern is shown by using two trend lines, one for drawing across two or more pivotal points and the other for connecting two or more pivotal lows. This pattern can be seen in the charts when the prices move upward, forming a pivot and representing highs and slow and then converging towards a single point that is known as the apex. To put it simply, the rising wedge is a technical indicator that suggests a reversal pattern and frequently occurs in bear markets. Why Is the Rising Wedge Pattern Important?.

STOCK MARKET RISING WEDGE HOW TO

How To Trade a Rising Wedge Stock Pattern ?.Is The Rising Wedge Bearish or Bullish?.How Does a Rising Wedge Stock Pattern Develop?.

0 kommentar(er)

0 kommentar(er)